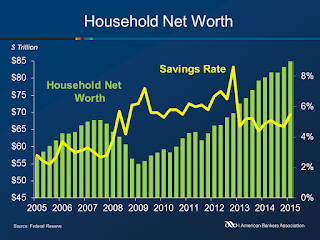

Household net worth increased by $1.6 trillion during the first quarter of 2015 to $84.9 trillion, a 2 percent increase over the fourth quarter and a 5.7 percent increase from a year ago.

Nonfinancial assets of households and nonprofit organizations increased 1.9 percent from the previous quarter and 5.7 percent over the previous year. Real estate values contributed to most of the growth, increasing 2.1 percent from the previous quarter and 6.3 percent from the previous year.

Financial assets of households and nonprofit organizations increased 1.6 percent from the previous quarter and 5.1 percent from the previous year. The quarterly growth was mainly driven by increases in time and savings deposits, corporate equities, mutual fund shares and pension entitlements.

Household debt increased 2.2 percent annually to $14.2 trillion (excluding charge-offs of home mortgages). Mortgage debt excluding charge-offs decline 0.3 percent at an annual rate. Consumer credit climbed, increasing 5.6 percent from the previous quarter.

The household saving rate jumped to 5.5 percent in the first quarter, 0.8 percentage points above the fourth quarter 2014 and 0.6 percentage points above the first quarter 2014.

Nonfinancial business debt rose at an annual rate of 6.6 percent, driven by an increase in corporate bonds and foreign direct investment in the U.S.

Federal government debt decreased at an annual rate of 0.4 percent, a drop from the positive 5.4 percent annual rate in the previous quarter. Conversely, state and local government debt rose at an annual rate of 4.8 percent in the first quarter.