By Kristin Sundin Brandt, CFMP

Here’s the thing about most financial advertising – it’s wordy. Beyond the snazzy headlines and sales copy, the ads are full of rates, terms and mandatory disclosures (also know as “mice type.”)

The natural verboseness of these ads can cause some head scratching for those marketers and designers looking to communicate the same information through more restrictive channels – specifically . . . Facebook.

For those unfamiliar, Facebook, in an attempt to control the look of the newsfeed, mandates advertisements have text on no more than 20% of the image. (The actual explanation is “Too much text can look like spam and make people think that your ad is low quality.”)

But it’s actually more restrictive than that – in fact, Facebook restricts advertisers to images within five blocks of their advertising grid.

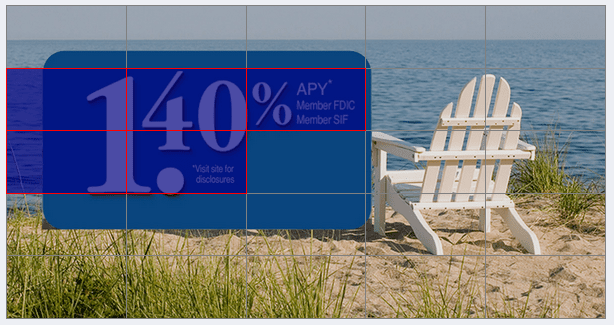

While there is no question that Facebook would prefer advertisers run ads featuring big, beautiful photography – that isn’t always possible, especially for an institution looking to advertise rate. So what’s an advertiser to do?

Embrace the blocks Create a template with the grid in your favorite design program, and focus on how you can utilize the blocks most effectively. Don’t be afraid to move items you would traditionally put in the footer.

Moving disclosures up near the rate allows us to stay within the 5 blocks.

Break up the campaign Advertising multiple rates? Create multiple ads, which not only allows you to maximize the available space, it also means you can track interest in each rate option and reallocate your budget if you see a difference.

Think outside the blocks Unlike a billboard, which also requires a “less is more” strategy, your Facebook ad is flanked by additional information, including your logo (assuming you are connecting it to your company’s Facebook Page).

So keep it simple and focus on how you can use the headline, text, and news feed links – making sure the rest of the mandatory disclosures are within one click.

With a little creativity it’s easy to embrace the blocks!

Kristin Sundin Brandt, CFMP, is the president of Sundin Associates Inc., Natick, Mass., an agency specializing in financial services companies.

Online training in Facebook from ABA.