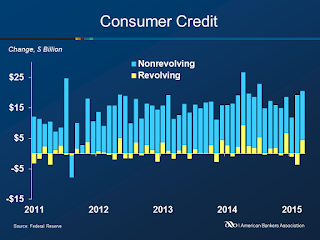

Consumer credit increased at a seasonally adjusted annual rate of 7.4 percent in March to $3.36 trillion. Revolving credit rose 5.9 percent (to $889 billion) and non-revolving credit increased by 7.9 percent ($2.47 trillion). Consumer credit rose at an annual rate of 5.4 percent for the first 3 months of 2015.

Total outstanding consumer credit increased by $20.5 billion, up from an increase of $14.8 billion in February. Total outstanding non-revolving credit increased by $16.2 billion, while outstanding revolving credit increased by $4.4 billion.

Federal government holdings of student loans continue to be the largest portion of non-revolving credit, making up 36 percent of outstanding credit. Finance companies and depository institutions are the secondary holders of non-revolving credit, each holding approximately 25 percent. Depository institutions continue to be the primary holder of revolving credit, holding 82 percent.